Ira tax deduction calculator

Discover Fidelitys Range of IRA Investment Options Exceptional Service. Contributions are made with after-tax dollars.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

. The calculator will estimate the monthly payout from your Roth IRA in retirement. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Find out how much you contributed to your IRA this tax year.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Ad Contributing to a Traditional IRA Provides for Tax-Deferred Growth. The after-tax cost of contributing to your.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Your IRA custodian should send you a statement for tax. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

Ad Make a Thoughtful Decision For Your Retirement. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Less than 140000 single filer Less than 208000 joint filer Less than.

Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. You can contribute to a Roth IRA if your Adjusted Gross Income is.

The after-tax cost of contributing to your. Follow these three steps to calculate your IRA deduction. Retirement plan at work.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. Traditional IRA Calculator Details To get the most benefit from this. Ad TIAAs Tools Can Help You Estimate Your IRA Contribution Limit.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. A Traditional IRA Can Be an Effective Retirement Tool. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies.

The after-tax cost of contributing to your. The after-tax cost of contributing to your. While long term savings in a.

Traditional or Rollover Your 401k Today. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. You can add another 1000 to that.

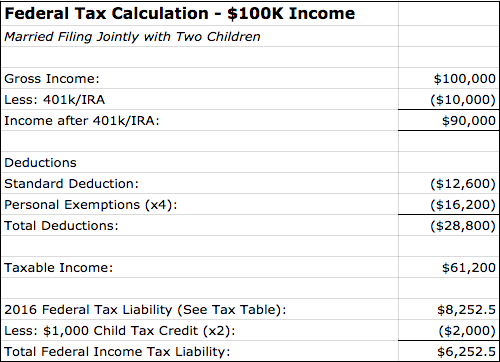

AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. If you have a traditional IRA rather than a Roth IRA you can contribute up to 6000 for 2021 and 2022 and you can deduct it from your taxes. Use this calculator to help you determine whether or not you are eligible to contribute to both the Traditional IRA and Roth IRA and the maximum amount that may be contributed.

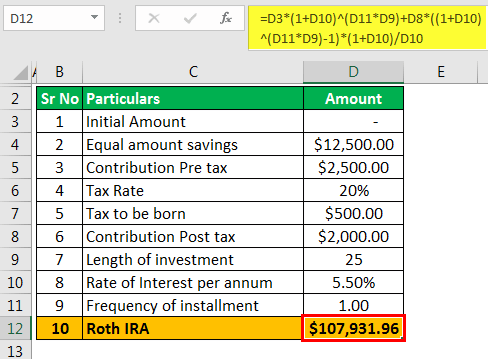

If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. Money deposited in a traditional IRA is treated differently from money in a Roth.

If its not you will. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Discover The Answers You Need Here.

Paying taxes on early withdrawals from your IRA could be costly to your retirement. Open an IRA Explore Roth vs.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

How To Calculate Taxable Income H R Block

:max_bytes(150000):strip_icc()/IRArecharacterizationformulaexample-e0acc0d7ed1e40839341e1bcbcc61c4d.jpg)

Recharacterizing Your Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

Contributing To Your Ira Start Early Know Your Limits Fidelity

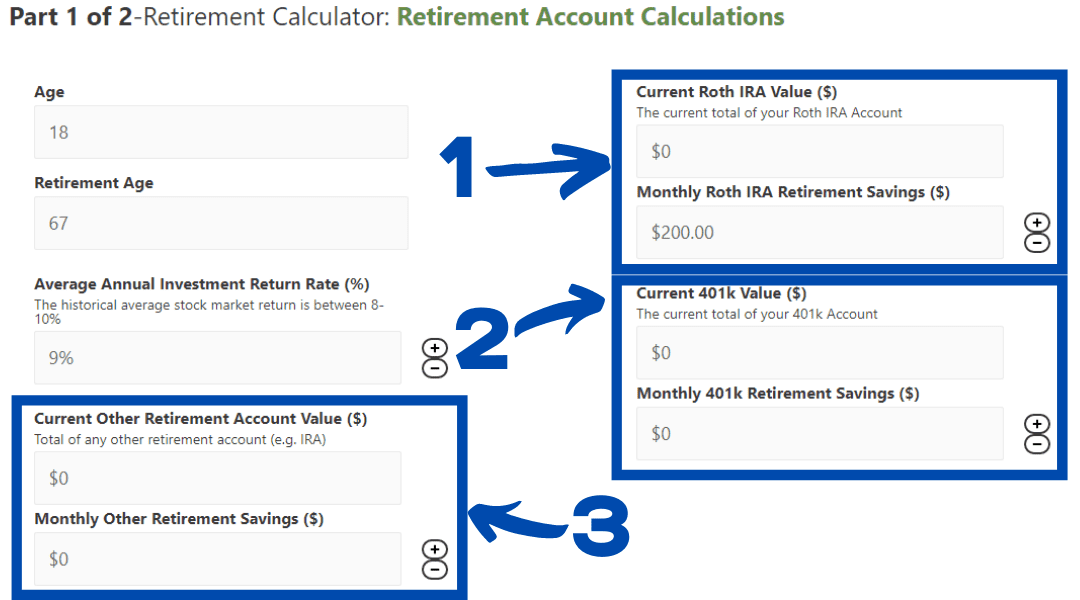

Retirement Calculator With Social Security 401k Roth Ira Start Planning Retirement Now Yp Investors

How A Family Of Four With A 0 000 Yearly Income Pays Only 252 In Federal Income Tax Richmondsavers Com

Federal Income Tax Calculator Atlantic Union Bank

Ira Retirement Calculator Forbes Advisor

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

New 2022 Ira Limits Get Ready Now

Pin On Finances

Payroll Taxes Aren T Being Calculated Using Ira Deduction

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Roth Ira Calculator Calculate Tax Free Amount At Retirement